The Art Of Buying Your Dream Home

Without Getting Screwed

Buy the home of your dreams at the Right Location, the Right Price, and the Right Financing. Start painting your canvas with a lifetime of beautiful and colorful memories.

and lenders don’t know real estate.

-Uncle Drew

Real Estate Experience

'Nieces & Nephews'

Raised

why work with uncle drew?

- Financial & Credit Clarity

Know from day one how the numbers work and how they impact you.

- Mortgage 2nd Look Review

I provide a FREE review of your mortgage financing options to optimize our chances of an accepted offer in this highly competitive market..

- Perfect Home in the Perfect Place at the Perfect Price

I offer a FREE detailed home market analysis so you know how to choose the best price point for your home that will attract qualified buyers.

- Stress Free Home Buying & Selling

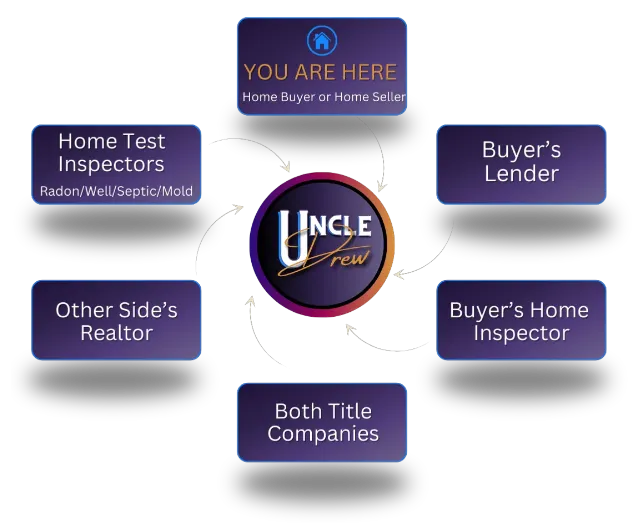

I will serve as your quarterback, managing all of the players on the field, including realtors, lenders, inspectors, title agents, etc.

- Professional Negotiation Wiz

Advocating for my ‘Nieces & Nephews’ is my #1 priority.

You Don't Get Screwed

Schedule

Your FREE One-on-One Home Buyer Consultation

Let’s talk about your goals and dreams with the new home. We will discuss your wants and wishes, your budget, and your deal-breakers.

I will take the time to understand your unique needs and preferences and help you find the perfect home, in the perfect place, at the perfect price.

Choose a date and time that works best for you.

Let's Talk...

uncle drew's 5 steps to finding your perfect home

FREE CONSULTATION

A 1 on 1 consultation will allow me to learn all about you and your home buying goals. I want to know where you are at now, and where you want to be in the future. Together, we will design a home buying blueprint that will not only propel you into home ownership, but one that will also provide you peace.

THE QUESTIONNAIRE

This quick questionnaire will help me learn more about you, your family, and your home buying goals so that I am best prepared for our conversation. I want to know all of the details so that you can make quality decisions based on solid advice, and I can connect you to the right resources that will help along the way.

YOURSELF PREPARED

I have put together a playlist of videos explaining various facets of the home buying process. Remember, there is power in knowledge. Please watch these videos as you see fit and as they apply to your situation, especially if you are a first time home buyer. I will answer your questions when we talk.

PRE-APPROVED

To optimize your property search and make a compelling offer, it’s crucial to establish your budget and obtain pre-approval for financing before searching for your dream home. However, you may want to wait to get pre-approved until after our 1 on 1 conversation so that I can answer any lender questions you may have.

SEARCHING

Enjoy your own personalized home search web portal and link directly to my entire database of Milwaukee area homes for sale. Search till your heart’s content. Save your favorite homes and let me know which homes you would like to tour. I will also put together my own exclusive list for you as I learn more about you and your family.

Let's get you into a new home!

SERVING 3 COUNTIES & BEYOND

MILWAUKEE COUNTY

Cultural Diversity and Urban

Vibes:

Milwaukee County is a vibrant and culturally diverse area, offering residents access to a rich tapestry of arts, music, dining, and entertainment. With its thriving downtown, historic neighborhoods, and a strong sense of community, Milwaukee County is a fantastic place to experience the urban lifestyle while still enjoying the charm of the Midwest.

Milwaukee County

Milwaukee

South Milwaukee

St Francis

Cudahy

Greenfield

Hales Corners

Franklin

West Allis

Wauwatosa

Shorewood

Whitefish Bay

Glendale

Brown Deer

WAUKESHA COUNTY

Natural Beauty and Outdoor

Adventures:

With its picturesque landscapes, numerous lakes, and abundant green spaces, Waukesha County provides ample opportunities for outdoor enthusiasts. Whether it’s boating, hiking, golfing, or simply enjoying the scenic beauty, this county is a haven for nature lovers and those seeking suburban tranquility, while keeping the big city just a short drive away.

Waukesha County

Waukesha

New Berlin

Brookfield

Menomonee Falls

Muskego

Oconomowoc

Pewaukee

Delafield

Butler

Dousman

Eagle

Elm Grove

Hartland

Lannon

Merton

Mukwonago

North Prairie

Oconomowoc Lake

Summit

Sussex

Wales

WASHINGTON COUNTY

Rural Charm and Small-Town

Atmosphere:

Washington County offers a peaceful and close-knit community feel, making it a great choice for those seeking a quieter, more rural lifestyle. With charming towns and a slower pace of life, it provides a respite from the hustle and bustle of larger urban areas. The county is blessed with beautiful parks, forests, and lakes, making it an outdoor haven.

Washington County

West Bend

Hartford

Germantown

Jackson

Kewaskum

Newburg

Richfield

Slinger

Take Back Ultimate Control

Uncle Drew's Screw Proof Home Buyer's Guide:

Mastering The Art Of Buying Your Dream Home Without Getting Screwed

BONUS #1:

The 9 Must-Ask Questions Beyond Rates And Closing Costs That Reveal the Right Lender for You

BONUS #2:

The 10 Must-Ask Questions Beyond The Number of Houses Sold That Reveal the Right Real Estate Agent for You

Get in Touch And Let's See What I Can Do!

Top 5 Complaints About Realtors & Lenders

LOUSY

COMMUNICATION

“I Never Know What’s Going On & What’s Next.”

NOT RESPECTING MY

BUDGET

“Stop Pressuring Me With Bigger Homes & Loans.”

POOR

NEGOTIATIONS

“I Could Have Negotiated Things Better On My Own.”

LACK OF TRUST &

GUIDANCE

“Are You Thinking About ME, Or Your Commission?”

VERY LITTLE

CLARITY

“Wait. How Much Are My Closing Costs?”

this is the way to remedy those complaints

There are numerous players involved when buying or selling a home and it is very difficult to manage them all efficiently on your own without getting screwed. But with Uncle Drew as the team manager, getting screwed is no longer your worry.

Their Way

Uncle Drew's Way

they call me uncle drew

I call him Uncle Drew because he doesn’t tell you only what you want to hear. He tells you the truth, even if it hurts or disappoints a little bit. That truth, helped me make the best decisions when buying a home for me and my family and I didn’t get screwed on anything.

Jonathan James

Real Estate 'Nephew'

…because he treats me like family. Well, actually better than some of my family. I had a very embarrassing situation with my credit scores and he guided me through it, made sure I took responsibility so I wouldn’t repeat my mistakes, and built me back up again.

Shay Martin

Credit Score 'Niece'

I was hell bent on a 15 year mortgage term to pay off my house early. Uncle Drew told me that he didn’t think that was the best decision because my job wasn’t stable. Had I not listened, I would have lost my home after I lost my job. Instead, I got along just fine. He was so right!

Kevin Montgomery

Mortgage 'Nephew'

Frequently asked questions by home buyers

How much does it cost to work with a Realtor or real estate agent when I buy my house?

Once a commission point is decided, the question becomes ‘how is the commission getting paid’?

There are a couple of ways to address this and due to many changes taking place in the real estate markets, these answers may change.

1. You, in need of a buyers agent, can certainly pay the commission amount that you and your agent agree to out of your pocket. (usually between 2% and 3% of the purchase price).

2. Traditionally, though this seems to be changing, you will find that the listing agent will split their commissions from the seller with your buyer’s agent. When this is the case, you are not coming out of pocket for any commissions to pay your buyer’s agent. The seller is kind of ‘paying it forward’ and will hope that their buyer agent commission will be taken care of on his/her next home purchase as well. Be sure to check with your agent as this traditional way of compensating the agent representing the buyer by splitting the listing agent’s commission, seems to be going by the wayside.

3. If the seller does not want to allow the listing agent the ability to pay the buyer’s agent commission, then you always have the option to ask for a credit from the seller to accomplish the same thing.

Again, things are changing rapidly when it comes to agent commissions so be sure to address this thoroughly with your real estate agent before moving forward.

Am I required to use the services of a Realtor or real estate agent to buy a home?

Can you explain the difference between a Realtor, a real estate agent, and a real estate attorney?

2. Real Estate Agent: A real estate agent is a licensed professional who facilitates property transactions. They can represent buyers or sellers in real estate deals, help clients find properties, arrange property showings, negotiate offers, and guide clients through the buying or selling process. Some real estate agents may be Realtors, but not all are NAR members.

3. Real Estate Attorney: A real estate attorney is a legal professional with expertise in property law. They provide legal services related to real estate transactions, such as reviewing contracts, ensuring legal compliance, resolving disputes, and handling the transfer of property titles. Real estate attorneys are typically consulted for complex or legally challenging transactions to protect their clients’ interests and ensure the legality of the deal. They don’t typically assist clients with showing properties or customer service.

How can I make my offer more competitive?

Should I get pre-approved with my lender before talking with you?

Here’s why. I have over 21 years of mortgage lending experience and 3 years as a Real Estate Closer for a title company. So, not only do I know real estate very well, but I also know mortgage lending AND because I helped people sign their financing paperwork as a Real Estate Closer, I am well aware of the reputations of hundreds of lenders out there. You will hear me say that one of the biggest problems in this industry is that Realtors don’t know mortgages and lenders don’t know real estate. I know both. Therefore, I would like to talk with you first so that we can be sure that your lender is focused on the loan program that will give you the best shot at getting an accepted offer. It makes a HUGE difference. If you already have a pre-approval letter in hand, no problem. I will double check it and make sure it is worth the paper it is written on.

This is not for the purpose of steering you towards my favorite lender. I don’t care who you use as your lender. What I DO care about is that they are optimizing our chances of getting that accepted offer and after 21 years in the field, I have a few solid tricks up my sleeve that most lenders don’t even know about to do just that. And don’t worry. Everything is legal, ethical, and above board. Regardless of the lender you choose, we want to ensure that your pre-approval letter is top notch.

What is the difference between a pre-qualification and a pre-approval letter?

Just like a pre-qualified credit card offer, a pre-qualified mortgage letter holds NO weight. It is basically a letter from a lender saying, ‘Yea, we looked at Joe’s credit scores and from what he tells me, I think he will qualify for a mortgage.’ Nothing has been documented, vetted, or verified. This won’t cut it.

You need a pre-approval letter from a lender. A true pre-approval letter from a lender tells the prospective seller the following:

- You completed the full mortgage application

- Your credit scores are high enough to qualify for a mortgage

- Your file has been approved through the Desktop Underwriter (software used by lenders to approve your loan)

- Your income and job history have been properly documented and verified

- Your sources of funds needed for the transaction have been fully verified

- Any other factors that could negatively impact you as a buyer/borrower have been vetted

- The letter will specify your maximum purchase price, down payment amount, type of loan you are using, and any other related information.

I was told that I don't qualify for a mortgage because of my low credit scores. How do I increase them?

This simple question is too complex and personalized for each individual to discuss here. However, I still offer a personalized credit analysis that will tell you exactly what steps to take to get those scores up there so that you can feel like a person again. Ask me about it or click on my ‘Credit’ page to learn more.

Should I do an FHA loan or a conventional loan for my mortgage?

We can do a deep dive on this for your situation to ensure that you are using the best loan program for you and for the chances of an accepted offer as well. While I won’t advise on anything mortgage related requiring a license, I can certainly talk with your lender or give you a list of the perfect questions to ask tailored to your situation.

Should I still be offering an amount over the asking price or has the market cooled?

My home inspection report is like 49 pages long. Am I buying a money pit?

You want to pay attention to things that will cost you big such as the HVAC, plumbing, basement, foundation issues, roof, etc. So while the report might be long and detailed, you will need to sort through it and disregard the little nit picky things. If you can live with the rest, then you should be in good shape. If the inspector has a lot items highlighted in red, deferred maintenance, less than 2 years life left on HVAC or roof, or big expensive items noted needing repair, then you may want to reconsider.

It really comes down to what you can live with paying for if it goes out. One thing you can do to offset your risk is to purchase a home warranty or have your Realtor negotiate a home warranty paid for by the seller. It is not going to cover all of your costs should the HVAC go out but it will likely offset the cost. The cost of a home warranty, even if you have to pay for it yourself, is well worth the peace of mind as it will cover a lot of appliances in the new home.

Get Started On Your Home Buying Journey Today. Waiting Will Only Cost You More Tomorrow!

I would love to help you find your dream home in the greater Milwaukee area. Click the button below and schedule a consultation and learn more about my services and how I can help you find your dream home.